Budgeting Made Easy: Features in Financial Apps You Should Know

In today’s fast-paced world, managing personal finances can be a daunting task. However, with the rise of financial apps, budgeting has become more accessible and efficient. These apps offer a variety of features designed to help users track their spending, set savings goals, and ultimately take control of their financial lives. This article explores the key features of financial apps that make budgeting easier and more effective.

1. User-Friendly Interface

One of the primary advantages of modern budgeting apps is their user-friendly interfaces. Most apps are designed to be intuitive, making it easy for users to navigate and understand their financial situations. A clean layout with clear icons and straightforward navigation helps users quickly access important features without feeling overwhelmed, including options to invest in mutual funds alongside their budgeting activities. This integration allows users to manage their overall financial health more effectively.

2. Expense Tracking

Expense tracking is a fundamental feature of budgeting apps. Users can categorize their spending—such as groceries, entertainment, and transportation—allowing them to see where their money is going. Many apps automatically sync with bank accounts and credit cards, making it easy to record transactions in real time. This feature helps users identify spending patterns and make informed decisions about their finances.

3. Budget Creation

Creating a budget is essential for effective financial management. Most budgeting apps allow users to set monthly budgets based on their income and expenses. Users can allocate specific amounts to various categories, such as housing, food, and savings. The app then tracks actual spending against these budgets, helping users stay within their limits.

4. Goal Setting

Financial apps often include goal-setting features that encourage users to save for specific objectives, such as vacations, new cars, or emergency funds. Users can set target amounts and deadlines, and the app will provide progress updates. This feature motivates users to save and helps them visualize their financial goals, making it easier to stay committed to their budgeting plans, even if they are also considering investments in the commodity market.

5. Bill Reminders

Keeping track of bills can be challenging, but many budgeting apps offer bill reminder features. Users can input their recurring bills, such as rent, utilities, and subscriptions, and set reminders for payment due dates. This helps prevent late fees and ensures that users stay on top of their financial obligations, contributing to better budgeting practices.

6. Visual Reports and Analytics

Many financial apps provide visual reports and analytics that help users understand their financial health at a glance. Charts and graphs display spending trends, savings progress, and budget adherence. This visual data makes it easier to identify areas for improvement and adjust spending habits accordingly.

7. Customizable Categories

Not all expenses fit neatly into standard categories. Some budgeting apps allow users to create customizable categories that reflect their unique spending habits. This flexibility ensures that users can track their expenses in a way that makes sense to them, enhancing the app’s effectiveness in managing their finances.

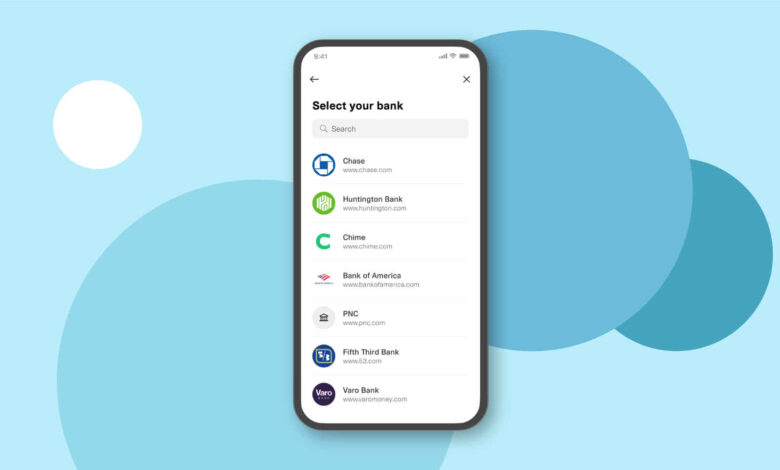

8. Integrations with Other Financial Tools

To streamline financial management, many budgeting apps integrate with other financial tools, such as investment accounts and savings accounts. This feature allows users to view all their financial information in one place, providing a comprehensive overview of their financial health. By consolidating data, users can make more informed decisions about budgeting and saving.

9. Educational Resources

Many financial apps include educational resources to help users improve their financial literacy. These resources can range from articles and videos to budgeting tips and financial planning guides. By providing users with the knowledge they need, these apps empower individuals to make better financial choices and enhance their budgeting skills.

10. Security Features

With the increasing prevalence of online financial management, security is a top concern for many users. Most budgeting apps employ strong security measures, such as encryption and two-factor authentication, to protect users’ sensitive financial information. Knowing that their data is secure allows users to engage with these apps confidently.

Conclusion

Budgeting apps have revolutionized the way individuals manage their finances, making budgeting easier and more accessible than ever before. With features such as expense tracking, goal setting, bill reminders, and customizable categories, these apps empower users to take control of their financial lives.

By leveraging the tools and insights offered by these applications, users can develop better budgeting habits, save for their goals, and achieve greater financial stability. As technology continues to evolve, we can expect even more innovative features that will further simplify the budgeting process, helping individuals navigate their financial journeys with confidence. Whether you’re looking to get your finances in order or simply want to track your spending, a budgeting app could be the key to achieving your financial goals.